A good starting point is the first step to success. There are 10 good reasons why you should buy Swiss real estate funds right now to build up your wealth over the long term. And these factors are at the same time a guarantee for long-term secure and stable returns. Over the last five years, the index of listed real estate funds came to a total return of 7.25% per year. Over the last 50 years, Swiss real estate funds have achieved an average performance of around 6% per year. Here I explain why now is the right time.

1. Buying opportunity? Perhaps the best time in your life

Following the historic decline in the price of listed Swiss real estate funds (SWIIT) in 2022, I now consider investments in real estate funds to be historically attractive. Not even during the 2008 financial crisis did the index suffer a setback as large as the one in 2022, when it lost nearly 20%. This plunge offers a once-in-a-lifetime buying opportunity. For example, I would take a look at the listed Helvetica Swiss Commercial Fund. Distribution yield almost 5.5%. And the fund is perfectly positioned for the economic upswing.

2. Perfect timing? No doubt yes.

Act Now. As an entrepreneur with 25 years of investment experience, I am convinced that now is perfect timing if you want to build wealth over the long term and do so with very moderate risk. Real estate funds generate attractive investment and distribution returns over the long term. And if you don't want to have direct investments, a contribution in kind to one of our funds is very appealing. I am convinced that real estate funds are trading far below their fair value. The right time to enter: now. Act as quickly as possible!

3. Is your money sleeping? In the bank account, always!

While you get poorer every day with your savings account, the value of a real estate fund unit increases steadily. Get rich immediately? No, solid investments always require a long-term approach and patience. All funds are subject to the strict supervision of FINMA. A high level of investor protection is therefore guaranteed. The impressive figures: Swiss real estate funds have achieved an average performance of around 6% per year over the last 50 years. The advantages are evident: you even make money while you sleep. Good night.

4. Better to have wings than gold?

History has confirmed it: Inflation gives wings to real estate funds. Real estate therefore offers the best inflation protection in inflationary phases. If interest rates rise, inflation rises, so does rental income. In inflationary times, real estate investments become more attractive because they act as tangible assets, as a safe haven. This is because both rental income and property prices always rise in line with inflation rates. Real estate funds are better than gold.

5. Are we in for a golden age? I say yes.

Inflation shock on the housing front. The latest figures from the real estate market are abundantly clear. Even the blinds must see it: In our country, apartments are scarcer than at any time in 20 years, and the vacancy rate is still 1.3%. On the other hand, the number of building permits is falling steadily. The accumulated inflation in combination with the long-term decline in construction activity as well as high migration will lead to significantly rising market rents and values in the medium term. Real estate analysts share our opinion.

6. Numbers say more than a thousand words.

There is no need for a state guarantee. The facts speak for themselves. Real estate funds have been paying out attractive profits for decades. Measured against most valuation criteria, real estate investments clearly outperform other asset classes. And over the long term, these types of investments produce the best returns. The total return from dividends and performance has been over 7% per year for the past 15 years. Conclusion: Real estate funds have been top performers for decades. It pays to get in now.

7. Available at all Swiss banks. Why wait?

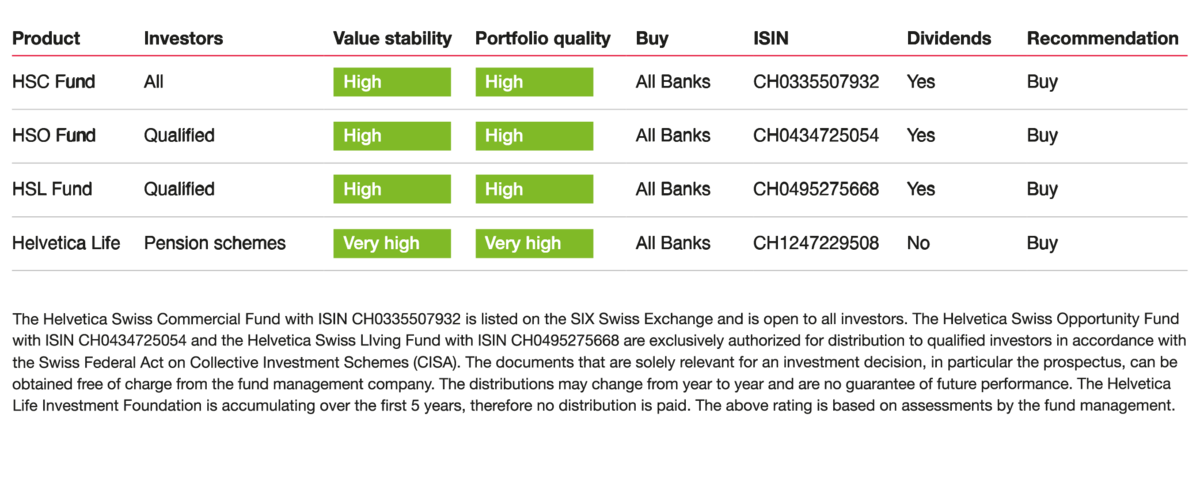

Become a real estate investor today. Get more out of your money. Regular reporting by real estate funds ensures transparency and security. You can purchase fund units at all Swiss banks. Ask your bank about the listed Helvetica Swiss Commercial Fund. Real estate fund units can be traded at any time. PS: Say hello from Hans R. Holdener.

8. High dividend opportunities for patient hunters.

It's a shame: the savings account has been a losing investment for years. Far more interesting are investments in real estate funds. And already for less than 100 Swiss francs you can become a real estate investor. With a distribution yield of almost 5.5% for 2022, the Helvetica Swiss Commercial Fund with ISIN CH0335507932 has once again lived up to its reputation as the best real estate fund in Switzerland and as a dividend pearl. We don't give wings, just steady profits. Get in.

9. Solid investment return? Doesn't happen by accident!

The fund management companies are professional organizations with a long track record and have extensive experience in all areas of the real estate market. They deal with the market on a daily basis and are therefore proven experts in their field. This ensures that the properties are managed to preserve their value over the long term. A clear advantage for you. Your money never sleeps.

10. Missed the opportunity again? No problem.

The bet is on: the best time was not 20 years ago, the best time is today. The historic 2022 price setback offers a once-in-a-lifetime buying opportunity. Real estate funds have proven to be very stable for decades, and I am optimistic that this asset class will continue to perform very well in the future. Ask your bank about the Helvetica Swiss Commercial Fund with ISIN CH0335507932. Because now is the moment.