Buy real estate funds now

No doubt: Now is the perfect time to buy real estate fund units, says Hans R. Holdener, founder of Helvetica, with utter conviction. After all, these units have fallen massively in value since the beginning of the year and are now cheaper than ever before. Fund units can even be bought below their net asset value (NAV).

Interview: Fredy Gilgen

Hans R. Holdener, according to a Finews interview, you are one hundred percent convinced that there has never been a better time to invest in real estate funds for the long term. What makes you so sure?

There are the same several reasons. Listed real estate funds have lost value to a historic extent since the beginning of the year. As a result, they can even be purchased below their NAV. As a real estate expert with more than 25 years of experience, I am convinced that this severe setback is absolutely disproportionate. In my view, there is now a historic buying opportunity. Now is the right time to buy real estate fund units and then hold them for the long term.

Can this also be justified on the basis of historical experience?

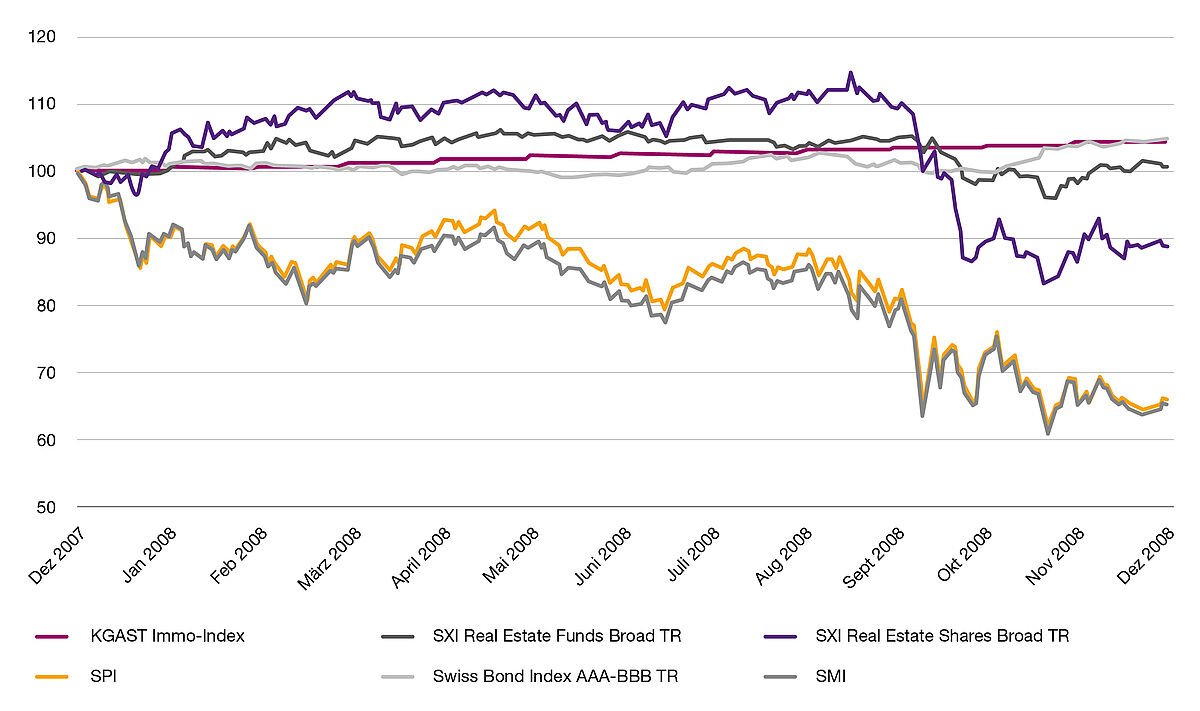

Absolutely. During the financial crisis of 2008, the worst crisis since the Great Depression in the 1930s, real estate funds proved to be a rock: the SXI Real Estate Funds Broad TR Index1 outperformed all other asset classes and ended the year with a positive net return of +0.53%. The other investments slumped by 34% to 90%, as a glance at Figure 1 shows.

But everything is different now?

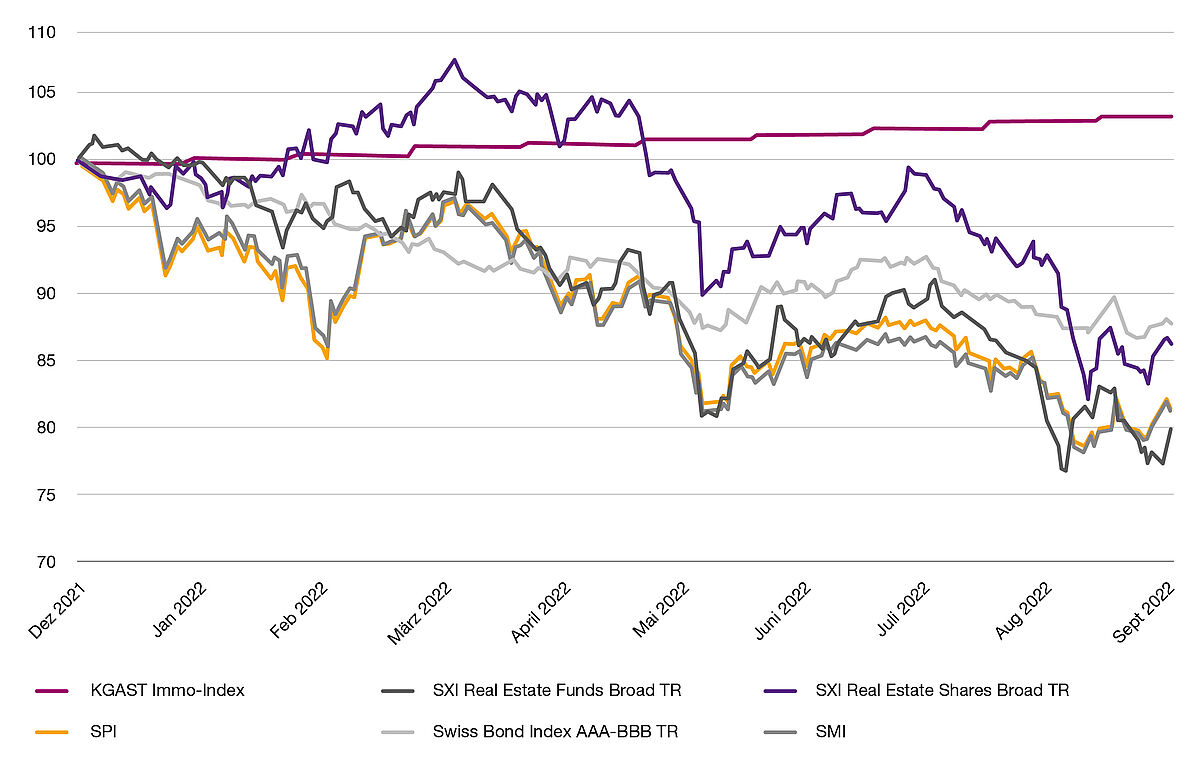

Yes, that's true. The markets have performed completely differently in the first ten months of this year. The SXI Real Estate Funds Broad TR, which was so stable 14 years ago, plunged 20%, as Figure 2 shows. This is a decline unprecedented since 1938, when records began. The SXI Real Estate Funds Broad TR fell even more than the SXI Real Estate Shares Broad TR2 by 7%, and that too is unprecedented. Compared to the two real estate fund indices, the SMI Index stock index did even less poorly this year, losing 16.7%. Also historically.

The table above shows extreme swings that have never been seen before. Not even during the great financial crisis in 2008 did the SWIIT, the index of listed Swiss real estate funds, suffer a setback similar to that of the current year.

Why will 2022 be better than 2008?

We have to go back a bit: In 2008/09, the Swiss National Bank lowered the key interest rate in five steps to 0.25%. The inflation rate fell to -0.4% by March 2009. By contrast, the unemployment rate remained relatively high at 3.35%. It rose even further to 4.8% by 2010. This combination of low inflation and high unemployment was and is undoubtedly a toxic environment for real estate.

And how does the situation compare in the current year?

Much better. The unemployment rate is hovering at record lows, reaching a modest 1.9% in October 2022, while at the same time inflation has risen to over 3% at times. These two factors will provide further impetus to real estate prices. This is despite the fact that financing costs have been rising for some time.

So, it is clear that the real estate market will continue to improve?

One can reasonably assume that it will. All in all, the prospects for the real estate market did not look very promising in 2008. Quite in contrast to the current situation. Now, all indicators speak for a positive real estate development. The prospects are positively bright. Added to this are strong fundamentals, such as a rock-solid economy, construction activity that has been on the decline for a long time, and record-high immigration. The clear conclusion: in 2008, the environment for the real estate market looked rather bleak, but in 2022, the outlook is excellent.

So it seems clear that the current setback in real estate funds is far exaggerated. Does that mean, now immediately access?

The facts speak for it. Over the last five years, the overall index of listed real estate funds produced a total return of 7.25 percent per year. After the historic price decline of the index of listed Swiss real estate funds (SWIIT) since the beginning of the year, I now consider investments in real estate funds to be extremely attractive. As I mentioned at the beginning, not even during the last major real estate crisis in 2008 did the SWIIT suffer a setback of the same magnitude as in the current year. As an entrepreneur who has been active in the market for more than 25 years, I am convinced that this historic setback is clearly exaggerated and that a unique buying opportunity now presents itself.

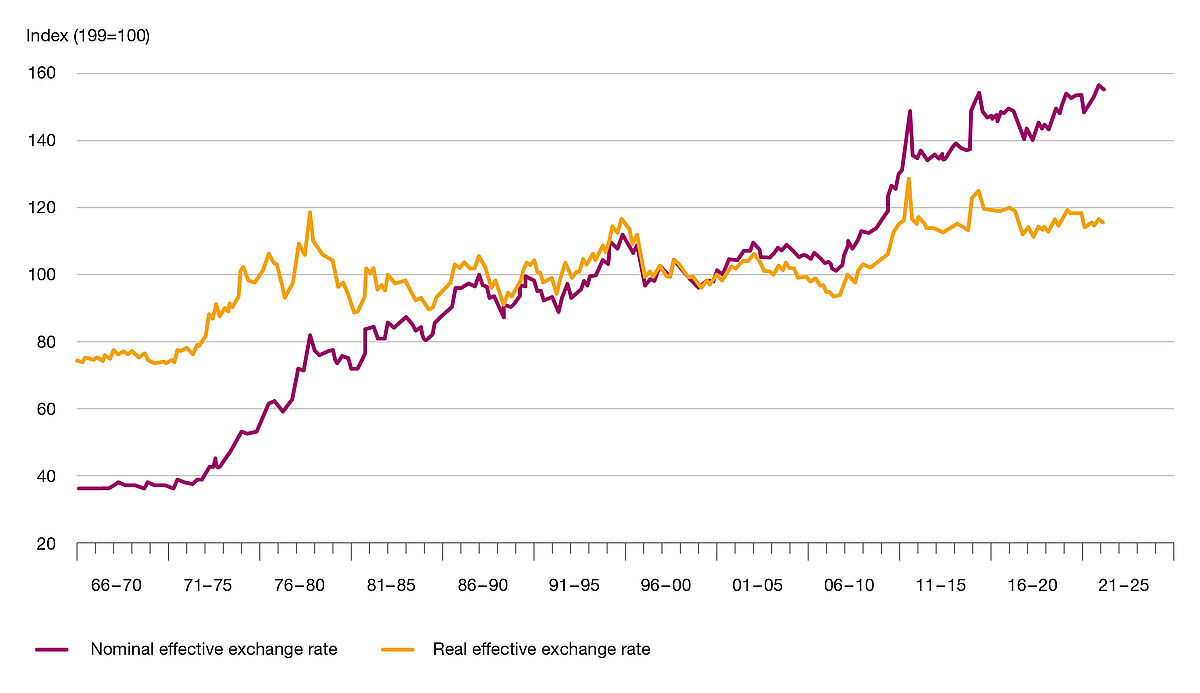

Because of the strong franc, the prospects for foreign investors should be even better.

That is correct. For Swiss investors, it is a favorable buying opportunity, and for foreign investors, the current situation looks even better, because the strong Swiss franc also acts as a free hedge

You are convinced that the Swiss real estate asset class could even become the new gold standard. Can it really succeed in doing so?

Yes, I am absolutely convinced that the Swiss real estate asset class could become the new gold standard. This is thanks to the economic strength of our country. The Swiss economy has a whole range of assets: it is broadly diversified, extremely solid and secure. Switzerland is rightly considered the safest country in the world, and it has other undisputed advantages. Off the top of my head, the following plus points come to mind: Switzerland is one of the most competitive economies in the world. It also has a very low unemployment rate and a relatively low inflation rate. The Swiss franc is also one of the strongest and most stable currencies in the world. Not to forget, finally, the very stable political environment.

What makes Swiss real estate such an attractive asset class?

The Swiss real estate market has become an attractive asset class for many investors. It combines the advantages of one of the most competitive economies in the world with a perfectly stable environment and offers attractive risk-adjusted returns. As if that were not enough, rents are low by European standards when measured against disposable income, the market is efficient, and government transaction costs are low. An investor can therefore expect stable cash flows and long-term appreciation potential.

What other reasons also speak in favor of real estate funds?

You can list many: Swiss real estate funds have a long tradition. As the country's oldest investment funds, they have been offering investors access to the real estate market for decades. And since 1938, these funds have been generating safe, stable and attractive returns. The listed fund sector is also highly institutionalized and has a current market valuation of over CHF 60 billion. If you are looking for sustainable wealth accumulation over generations, this is the place to be. It's hard not to like this asset class.

How did the real estate fund sector perform?

There was no reason to complain: The performance was good: Real estate funds have generated stable returns over the past decades and regularly outperformed other asset classes. Especially important at the moment: real estate funds offer full inflation protection and growing cash flows in the long term. Private investors are not left out either. With less than 100 Swiss francs per fund unit, you are in. They can easily be bought and sold at your local bank.

Could you even make fast money by buying and redeeming real estate fund units at the moment, as was reported in a Finews interview? Is there any truth in this?

No, that's not true. Let me briefly explain how the cancellation of real estate fund units actually works in practice. If you buy fund units today for less than the net asset value, you can cancel the units with a notice period of twelve months to the following year-end. And you will not receive today's value, but the value determined at the end of the notice period. It takes another three to four months before you receive the money. This means that you will not have the money in your account until around 15 months later. There is no question of fast money.

So it's a high-risk strategy that doesn't work?

Exactly. It contains one big unknown too many, because as mentioned, the net value of a fund share is known after 12 months at the earliest. In addition, there is another factor: The cancellation of fund units results in a large administrative effort for the fund and causes corresponding fees. In addition, once the fund units have been cancelled, there is no going back for the investor. Regardless of how the price of the fund units develops later. If this price rises during the waiting period, the investor even makes high losses.

The fact stays: real estate funds are not appropriate for short-term trading.

That's right. Short-term profits are not possible with the acquisition and subsequent redemption of listed real estate fund units. Because the value of the unit will only become evident in the future, it is simply not possible to engage in risk-free arbitrage. Real estate or real estate funds were and are not trading instruments, but a long-term investment.

Why then is this idea presented so prominently. Among others also in Finews?

Once again, it is an idea that has not been thought through to the end. It is simply an abuse of an instrument that is supposed to serve investor protection and has always proven itself in the past.

Finally, do you have an insider tip?

Buy listed real estate funds - Now. I would look at the Helvetica Swiss Commercial Fund, for example. The fund is listed on the SIX Swiss Exchange and can be traded regularly. The fund is perfectly positioned for the economic upswing and is extremely solid.

Are you interested in real estate investments or one of our real estate funds? We would be happy to sit down with you to get to know your needs. Are you a qualified or professional investor? Would you like to know more? Contact me personally at CEO@helvetica.com